- When filing IT returns: anyone who is eligible to pay income tax is expected to file their IT returns. A PAN card is obligatory for the filing of IT returns.

- Proof of identity: The PAN card serves as a valid proof of identity.

- Tax deductions: as discussed earlier, one of the essential reasons to get a PAN card is for the purpose of taxation. Anyone who hasn’t linked their PAN number with their bank account and earns an annual interest on their savings deposit of more than Rs. 10,000/- would draw a TDS returns deduction of 30% rather than the otherwise prevalent 10%.

- IT refund: Oftentimes assessees end up with a higher TDS deduction than is warranted. The assessee is required to have a PAN linked to their bank account in order to claim a tax refund.

- Opening a business: in order to start a business, a company or business is required to have a PAN registered in its name. A Tax Registration Number (TRN) is needed for a business, and that can be obtained only if it has a PAN.

- Opening a bank account: Any public, private, or co-operative banks insist on an individual or company having a bank account in their name in order to open a savings or current account. Only under the Pradhan Mantri Jan Dhan Yojana can a person open a zero balance account by using voter card or any other proof of identity.

- Opening a Demat account: A PAN card is also a must in order for any individual or entity to open a Demat account so as to hold shares in a dematerialized form.

- The purchase and sale of immovable assets: one of the benefits of owning a PAN card is the eligibility of an individual or entity to enter into transactions concerning the sale or purchase of assets. A PAN is required so as to be quoted in the sale or purchase deed for any immovable property valued at Rs. 10 lakh or more.

- Foreign travel: Cash payments to do with foreign travel for an amount above Rs. 50,000/-, inclusding purchases made in foreign currencies, require a PAN.

- Time deposit: deposits with the post office, with co-operative banks, or with non-banking financial companies would also need a PAN. Also, deposits amounting to Rs. 5 lakh or more every year will require a PAN.

- Hotel and restaurant bills: payments of more than Rs. 50,000/- for hotel and restaurant bills require the payer to possess a PAN.

- Cash cards and pre-paid instruments: cash payments amounting to more than Rs. 50,000/- a year require that a PAN be quoted.

- Purchase or sale of goods and services: The purchase or sale of any goods or services for an amount of more than Rs. 2 lakh per transaction require a PAN.

- Bank drafts, pay orders, and banker’s cheques: A PAN card is needed for bank drafts, pay orders, and banker’s cheques for transactions over Rs. 50,000/- in a day.

There is an exhaustive list of documents required to obtain a PAN Card, to be submitted along with the PAN Card application form, whether Form 49A (for Indian persons or entities) or Form 49AA (for foreign persons or entities). The requirement for documents depends largely on the applicants themselves.

For an individual applicant:

Identity Proof which can be a copy of any one among the following:

- Any govt. issued ID – Aadhar, DL, Voter ID, etc.

- Arm’s License

- Pensioner Card which contains the applicant’s photograph

- A photo ID card which is issued by Central Government, State Government or a Public Sector Undertaking

- Central Government’s Health Scheme Card or Ex-Servicemen Contributory Health Scheme Photo Card

- An original bank certificate which is issued on the bank’s letterhead from the branch of the bank and attested by the issuing officer. Such a certificate should contain an attested photograph of the applicant along with the bank account number.

An address proof which can be a copy of any one of the following:

- Electricity, landline or broadband connection bill

- Postpaid mobile phone bill

- Water bill

- LPG or piped gas connection bill or Gas Connection book

- Bank account statement

- Credit card statement

- Deposit account statement

- Post Office account Passbook

- Passport

- Voter’s ID Card

- Driving License

- Property registration document

- Domicile certificate issued by the Indian Government

- Aadhar Card

- Original certificate from the employer provided that the employer is a reputed public or private corporation

Date of birth proof which can be a copy of any one of the following:

- Birth certificate which is issued by the Municipal Authority or any authorized authority

- Matriculation certificate

- Pension Payment order

- Passport

- Marriage certificate issued by Registrar of Marriages

- Driving license

- Domicile certificate issued by the Indian Government

- An affidavit sworn before a magistrate stating the applicant’s date of birth

For a Hindu Undivided Family (HUF)

- An affidavit issued by the Karta of the HUF stating the name, address and the father’s name of every coparcener as on the date on which the application is made.

- Identity proof, address proof and date of birth proof as in case of an individual for the Karta of the HUF.

For a company registered in India

- copy of the Certificate of Registration issued by the Registrar of Companies.

For firms and Limited Liability Partnerships formed or registered in India

- A copy of the Certificate of Registration issued by the Registrar of Firms or Limited Liability Partnerships.

- A copy of the Partnership Deed.

For Trust formed or registered in India

- Copy of Trust Deed or a copy of the Certificate of Registration Number issued by a Charity Commissioner.

For an Association of Persons

- Copy of Agreement/Certificate of Registration Number from Registrar of Co-operative Society or Charity Commissioner or other competent authority or any document issued by the Central/State Government which shows identity and address of applicant.

For individuals who are not Indian Citizens

- A proof of identity which can be any one of the following:

- Passport copy

- Copy of PIO card issued by the Indian Government

- Copy of OCI Card issued by the Indian Government

- Copy of other national or citizenship Identification Number or TIN attested by applicable ‘Apostille’, Indian Embassy, High Commission or Consulate where the applicant is based.

- Address proof can be any one of the following:

- Passport copy

- Copy of PIO card issued by the Indian Government

- Copy of OCI Card issued by the Indian Government

- Copy of other national or citizenship Identification Number or TIN attested by relevant ‘Apostille’, Indian Embassy, High Commission or Consulate

- Copy of bank statement of the residential country

- Copy of NRE bank statement in India

- Copy of resident certificate or Residential permit

- Copy of registration certificate issued by FRO

- Copy of VISA granted and appointment letter from any Indian company

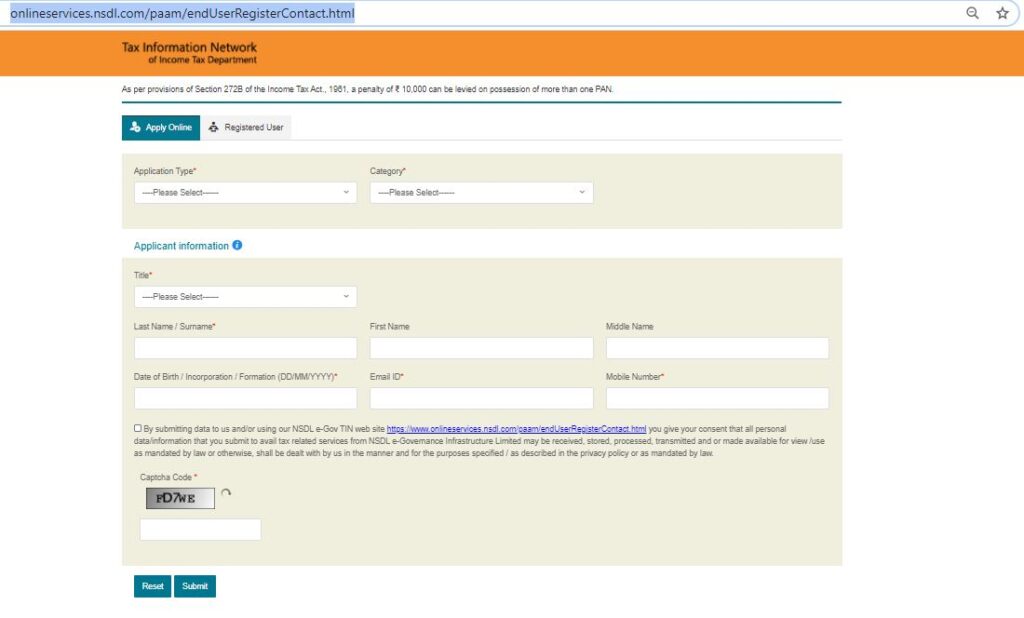

Visit nsdl website and fill in the details asked for below, enter the captcha code, and click on “submit.” Remember to make a note the token number that is then generated, and proceed with the PAN application.

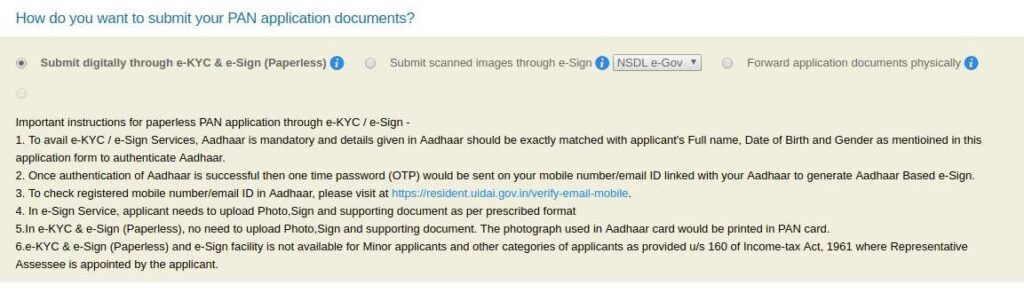

You should then be directed to a page outlining the three options you could use to submit the various proof documents mentioned above. You could submit them digitally using e-KYC and e-sign, submit scanned images via e-sign, or you can hand over the documents physically at your nearest branch (or send them in by registered post).

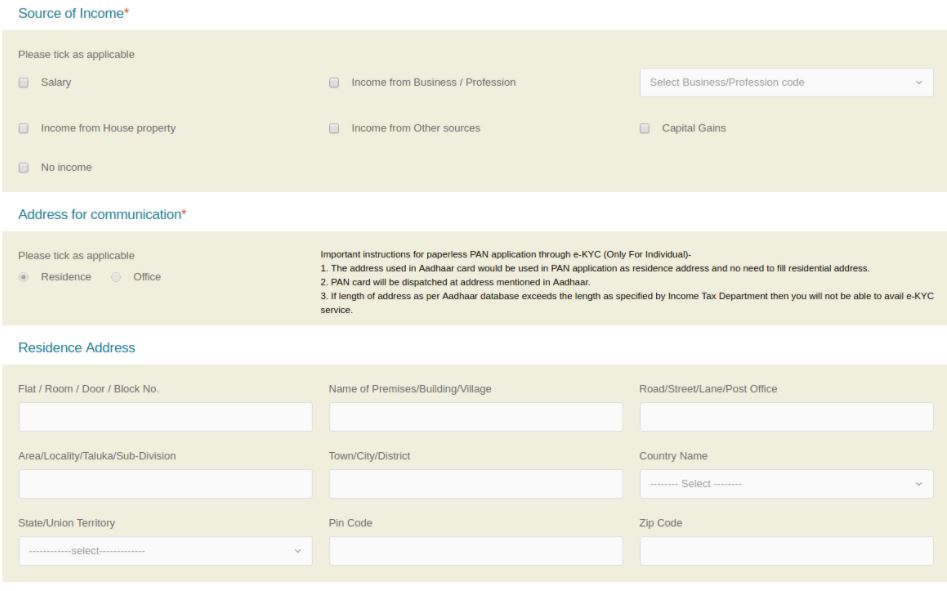

You will then be directed to a page where you need to fill in the details such as your sources of income and your address and other contact information.

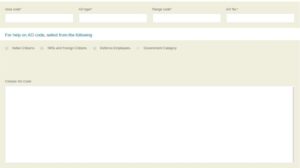

The next step is then so your Assessing Officer can be assigned and your tax jurisdiction can be understood. You can obtain all this information from the NSDL website by clicking the “AO Code Search for PAN” link. Then click on “next” to go to the document details & declaration section.

And lastly, you will need to provide information about all the documents you have submitted as your various proofs. You will also need to upload your photograph and signature. Do all this and click on “Submit.”

After submitting the application and making the payment, you will get an OTP on your mobile number linked to your Aadhaar number. Upon entering the OTP, you will receive a 15-digit acknowledgment number and a receipt, which you will need to print out. Sign this receipt and courier it to the NSDL office within 15 days from the application date. Remember to write/print on the envelope in block letters “APPLICATION FOR PAN-N-(15-digit acknowledgement number).”

You will be able to track the status of your PAN card application online on the NSDL by using your name and date of birth as entered in the form or through the 15-digit acknowledgement number.

New PAN Card Application: This application is for individuals who have never applied for a PAN Card before and want to obtain a new PAN Card.

Correction or Change in Existing PAN Data: This application is for individuals who already have a PAN Card but want to make changes to the existing data such as name, date of birth, address, etc.

Any Indian citizen or foreign national residing in India can apply for a PAN Card.

The following are the eligibility criteria for PAN Card:

a) Individuals

- Indian citizens residing in India

- Indian citizens residing outside India

- Foreign nationals residing in India

b) Companies and Firms

- Registered companies or firms in India

c) Trusts, Associations, and Societies

- Registered trusts, associations, and societies in India

d) Minor Individuals

- A minor can also apply for a PAN Card, but it needs to be applied through a guardian or parent.

The Permanent Account Number (PAN) provides each tax-paying entity of India with the following benefits:

- Identity proof

- Address proof

- Tax filing requirement

- Business registration

- Transfers of funds

- Bank Account Eligibility

- Phone Connection

- Gas connection

- With a PAN, it is beneficial to complete e-KYC.

On or after 1 September 2019, taxpayers must use Aadhaar instead of PAN when filing income tax returns under the union budget 2019. According to the 2019 union budget, the income-tax officer can assign PANs directly to taxpayers who file returns using Aadhaar.

- Fill out the form completely and accurately

- Submit valid identity and address proofs

- The signature should be within the designated space

- The photograph should be clear and recent

The applicant’s name should be spelled correctly.

If there is an error in your PAN Card information, you can apply for a correction in the following ways:

- Online Correction: You can visit the NSDL or UTIITSL website and apply for a correction by submitting the relevant documents.

- Offline Correction: You can download the form from the NSDL or UTIITSL website and submit the relevant documents along with the form to the nearest TIN facilitation centre.

To link your PAN Card number with your bank account, you can follow the steps given below:

- Visit your bank’s website or branch and complete the relevant form.

- Submit the form along with a copy of your PAN Card.

- After the verification process, your PAN Card will be linked to your bank account.

To check the status of your PAN Card application, you can follow the steps given below:

- Visit the NSDL or UTIITSL website

- Click on the ‘Track PAN Card Status’ option

- Select the application type, i.e., ‘New PAN Card’ or ‘Change/Correction in PAN Data’

- Enter your 15-digit acknowledgment number provided at the time of applying

- Enter your name and date of birth as mentioned in the application

- Click on ‘Submit’

- The status of your PAN Card application will be displayed on the screen. It will show whether your application is under process, dispatched or if there is any issue with the application.

To apply for a PAN Card, you can follow the steps given below:

- Visit the official NSDL or UTIITSL website

- Click on ‘Apply for new PAN Card’ or ‘Change/Correction in PAN Data’, depending on your requirement

- Select the appropriate application form, i.e., Form 49A for Indian citizens or Form 49AA for foreign nationals

- Fill in the form completely and accurately with your personal and contact details such as name, date of birth, address, mobile number, email ID, etc

- Upload the necessary documents, such as identity proof, address proof, and photographs, as specified in the application form

- Pay the application fee online using a credit card, debit card, or net banking

- After payment, you will receive an acknowledgment receipt with a 15-digit acknowledgment number

- Print the receipt and affix two recent passport-sized photographs on the receipt in the designated spaces

- Sign or thumb print the receipt in the designated space

- Attach the necessary documents, such as identity proof, address proof, and proof of payment, along with the receipt

- Send the application by post or courier to the address mentioned in the acknowledgment receipt

- After verification of the application, your PAN Card will be dispatched to your registered address within 15-20 working days.