- GST Eliminates Cascading Effect

Earlier there were many instances where tax on tax was paid for a single transaction. As GST did away with several other taxes like central excise duty, service tax, customs duty, and state-level value-added tax, you no longer are subjected to paying tax on tax. This saves you money.

- Higher Threshold

The threshold for GST is aggregate turnover exceeding 40 lakhs for sale of goods and aggregate turnover exceeding 20 lakhs for sale of services. This means small businesses falling below this threshold limit are not subject to GST Filing.

- Easier for Startups and E-commerce Businesses

The GST system has made it easier for startups and e-commerce companies to manage their taxes. E-commerce particularly suffered from different tax laws across different states which are now eradicated by GST.

- More Organised System

Before the GST tax return filing system was disorganised. Now, all taxes are paid online and major hassles that were a part of tax filing have been eliminated in the process of introducing GST.

- Invoices issued to persons with GSTIN or B2B invoices

- Invoices issued to persons without GSTIN or B2C invoices

- This needs to be submitted only when its total value is above ₹2.5 lakhs

- A consolidation of inter-state sales

- HSN-wise summary of all goods sold

- Any other debit or credit notes or advance receipts

It is crucial to complete the filing within the due date to file GST. This will help in avoiding late payment charges and interests. The due dates for filing GST returns can be extended as per the issuing order or through notifications. Vakilsearch has gathered a list of due dates to file GST for the financial year 2021- 2022 and 2022 – 2023.

Regular enterprises with an annual aggregate revenue of more than ₹5 crore

Taxpayers who did not choose the QRMP plan are required to file two monthly returns and one yearly return under the GST system

QRMP filers must submit nine GSTR files annually, which include four GSTR-1 and three GSTR-3B forms as well as an annual return. It should be noted that even if QRMP filers submit their returns on a quarterly basis, they must pay tax on a monthly basis

Additionally, separate statements and returns must be filed in other circumstances, such as in the case of composition dealers, who must submit five GSTR files annually (4 statement-cum-challans in CMP-08 and 1 annual return GSTR-4).

To make the GST payment post-login to the GST Portal once the challan is generated, perform the following steps:

- Access the https://www.gst.gov.in/URL. The GST Home page is displayed

- Login to the GST Portal with valid credentials

- Access the generated challan. Click the Services > Payments > Challan History command

- Select the CPIN link for which you want to make the payment

Note: In case you don’t know the CPIN number, you can select the Search By Date option to search the CPIN number by the date on which it was generated.

- Select the Mode of E-Payment

- In the case of Net Banking

- Select the bank through which you want to make the payment

- Select the checkbox for terms and conditions to apply

- Click the make payment button

- In the case of Credit/ Debit Cards

- Please select a payment gateway, select the payment gateway option

- Select the checkbox for terms and conditions apply

- Click the make payment button

In the case of Over the Counter

- In the payment modes option, select the over the counter as a payment mode

- Select the name of the bank where cash or instrument is proposed to be deposited

- Select the type of instrument as cash/cheque/demand draft

- Click the generate challan button

- Take a printout of the challan and visit the selected Bank

- Pay using cash/cheque/demand draft within the challan’s validity period

- The status of the payment will be updated on the GST Portal after confirmation from the bank.

In the case of NEFT/ RTGS

- In the payment modes option, select the NEFT/RTGS as a payment mode

- In the remitting bank drop-down list, select the name of the remitting bank

- Click the generate challan button

- Take a printout of the challan and visit the selected Bank. Mandate forms will also be generated simultaneously

- Pay using Cheque through your account with the selected bank/branch. You can also pay using the account debit facility

- The transaction will be processed by the bank and RBI shall confirm the same within <2 hours>

- Once you receive the Unique Transaction Number (UTR) on your registered e-mail or mobile number, you can link the UTR with the NEFT/RTGS CPIN on the GST Portal. Go to challan history and click the CPIN link. Enter the UTR and link it with the NEFT/RTGS payment

- The status of the payment will be updated on the GST portal after confirmation from the bank

- The payment will be updated in the electronic cash ledger in respective minor/major heads.

| GST Filing Returns | Purpose |

|---|---|

| GSTR1 | Tax returns for outward supplies are made using this form. It contains the details of the interstate as well as intrastate B2B and B2C sales including purchases under reverse charge and inter-state stock transfers made during the tax period. If Form GSTR-1 is filed late, the late fee will be collected in the next open return in Form GSTR-3B. From 1 January 2022, taxpayers will not be permitted to file Form GSTR-1 if they have not filed Form GSTR-3B in the preceding month. |

| GSTR1A | It is an amendment form used to correct the GSTR-1 document including any mismatches between the GSTR-1 of a taxpayer and the GSTR-2 of their customers. This can be filed between 15 and 17 of the following month. |

| GSTR2 | Monthly GST return for the received inward supplies are filed using this form. It contains taxpayer info, period of return and final invoice-level purchase information related to the tax period listed separately for goods and services. |

| GSTR2A | An auto-generated tax return for purchases and inward supplies made by a taxpayer is automatically compiled by the GSTN based on the information present within the GSTR-1 of their suppliers. |

| GSTR2B | GSTR-2B is an auto-generated document that acts as an Input Tax Credit (ITC) statement for taxpayers. The GST Council states that GSTR-2B will help in cutting down the time taken to file returns, minimise errors, ease reconciliation and simplify compliance. |

| GSTR3 | It is used to file consolidated monthly tax returns. It contains The taxpayer’s basic information (name, GSTIN, etc), period to which the return pertains, turnover details, final aggregate-level inward and outward supply details, tax liability under CGST, SGST, IGST, and additional tax (+1% tax), details about your ITC, cash, and liability ledgers, details of other payments such as interests, penalties, and fees. |

| GSTR3A | It is a tax notice issued by the tax authority to a defaulter who has failed to file monthly GST returns on time. |

| GSTR3B | Temporary consolidated summary GST returns of inward and outward supplies that the Government of India has introduced as relaxation for businesses that have recently registered to GST. |

| GSTR4 | It is the quarterly GST returns filed by compounding vendors. This contains the total value of supply made during the period covered by the return, along with the details of the tax paid at the compounding rate (not more than 1% of aggregate turnover) for the period along with invoice details for inward supplies if they are either imports or purchased from normal taxpayers. |

| GSTR4A | It is the Quarterly purchase-related tax return filed by composition dealers. It’s automatically generated by the GSTN portal based on the information furnished in the GSTR-1, GSTR-5, and GSTR-7 of your suppliers. |

| GSTR5 | Variable return for Non-resident foreign taxpayers (It contains the details of the taxpayer, period of return and invoice details of all goods and services sold and purchased. It also includes imports by the taxpayer on Indian soil for the registered period/month. |

| GSTR6 | This is the monthly GST return for ISDs. It contains the details of the taxpayer’s basic information (name, GSTIN, etc), period to which the return pertains, invoice-level supply details from the GSTR-1 of counter-parties, invoice details, including the GSTIN of the taxpayer receiving the credit, separate ISD ledger containing the opening ITC balance for the period, credit for ITC services received, debit for ITC reversed or distributed, and closing balance |

| GSTR7 | It is filed as a monthly return for TDS transactions. It contains the taxpayer’s basic information (name, GSTIN, etc), period to which the return pertains, supplier’s GSTIN, invoices against which the tax has been deducted. It is categorised under the major tax heads – SGST, CGST, and IGST. Details of any other payments such as interests and penalties are also included in the form. |

| GSTR8 | It is the monthly return for e-commerce operators. It contains the taxpayer’s basic information (name, GSTIN, etc), the period to which the return pertains, details of supplies made to customers through the e-commerce portal by both registered taxable persons and unregistered persons, customers’ basic information (whether or not they are registered taxpayers), the amount of tax collected at source, tax payable, and tax paid). |

| GSTR9 | This is an annual consolidated tax return It contains the taxpayer’s income and expenditure in detail. These are then regrouped according to the monthly GST returns filed by the taxpayer. |

| GSTR9A | It is an annual composition return form that has to be filed by every taxpayer who is enrolled in the composition scheme |

| GSTR9B | It is an annual return form that has to be filed by e-commerce operators who collect tax at the source |

| GSTR9C | This Audit form has to be filed by every taxpayer who is liable to get their annual reports audited when their aggregate turnover exceeds ₹2 crores in a financial year. |

| GSTR10 | Filing GST returns before cancelling GST registration This final GST returns is to be filed when terminating business activities permanently/cancelling GST registration. It will contain the details of all supplies, liabilities, tax collected, tax payable. |

| GSTR11 | Variable tax return for taxpayers with UIN It contains the details of purchases made by foreign embassies and diplomatic missions for self-consumption during a particular month. |

The government has been making strides towards innovation and automation and has instituted facilities for the online filing of returns under GST on the government’s GST portal, through the Goods and Service Tax Network (GSTN).

- Step 1: Go to the GST portal – www.gst.gov.in

- Step 2: Obtain a 15-digit GST Identification Number (GSTIN), which is issued based on your state code and PAN

- Step 3: Upload the relevant invoices on the GST portal. An invoice reference number against each invoice will be allotted

- Step 4: Once all the invoices, inward returns, outward returns, and cumulative monthly GST filing returns are uploaded, verify all the data you have inputted and file your returns.

Vakilsearch is well-known for its user-friendly online platform with which you can avail of GST filing services from the comfort of your home. The dedicated representatives of Vakilsearch will be in constant touch with you right from the start. They will collect all the required documents and do the needful.

The status of the Filing GST return application depends upon the performance of the obligation, and the status available would make the taxpayer aware of their filing.. Basically there are four statuses and they are explained below.

- FILED-VALID: When the GST return Filing is being filed by the registered taxpayer and has fulfilled all the requirements

- FILED-INVALID: When the tax is partly or fully remains unremitted

- TO BE FILED: GST Returns is due but has not been filed

- SUBMITTED BUT NOT VALID: In cases where the return has been validated but the filing is pending.

The penalty for late filing of GST return in India is as follows:

- Late fee: A late fee of₹ 50 per day of delay is charged for late filing of GSTR-3B. The maximum late fee for GSTR-3B is ₹5,000.

- Interest: Interest is charged on the outstanding tax liability from the due date of filing the return until the date of payment. The interest rate is 18% per annum.

In addition to the late fee and interest, the GST department may also impose other penalties for late filing of GST returns, such as:

- Suspension of GST registration: The GST department may suspend the GST registration of a business that fails to file GST returns for three consecutive months.

- Cancellation of GST registration: The GST department may cancel the GST registration of a business that fails to file GST returns for six consecutive months.

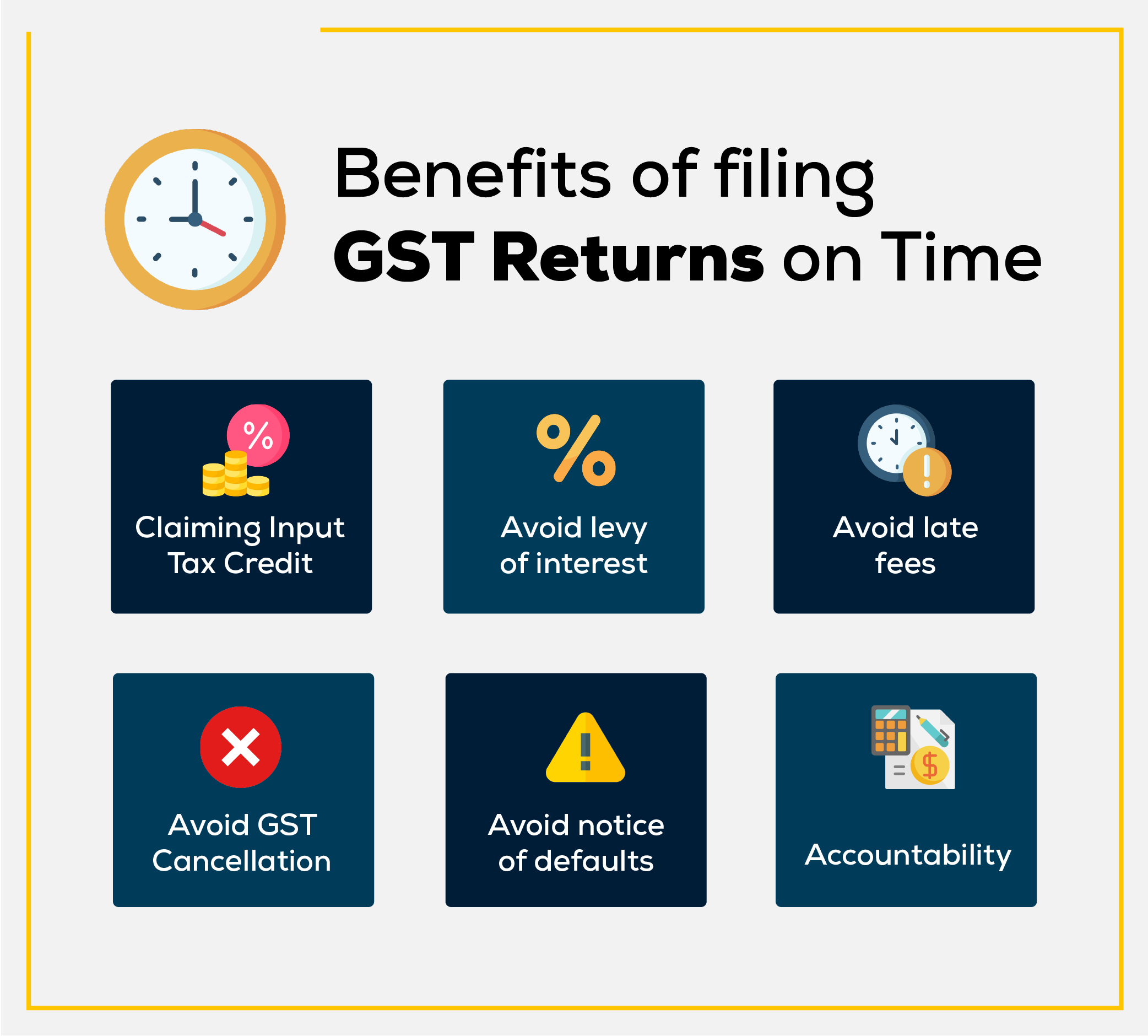

Businesses should therefore ensure that they file their GST returns on time to avoid penalties and other consequences.

There are three easy ways to track GST returns status online

Tracking Through ARN

When submitting the tax return, taxpayers are allotted a unique number called an ARN which helps in tracking the status of the tax return which is to be done every month. Steps to view the status through ARN are explained below:

- Step 1: Visit the official GST portal and log in to your user portal by filing down the required credentials or entering the valid details

- Step 2: Click of the Services > Returns > Track Return status

- Step 3: Enter the ARN number which has been sent to the registered email address of the taxpayer and click on the search key.

On clicking on the search option, there would be a full display of the return application status which will be having all the relevant details.

Tracking through GST Returns Filing Period

- Step 1: Visit the official GST portal and log in to your user portal by filing down the required credentials or entering the valid details

- Step 2: Click of the Services > Returns > Track Return status

- Step 3: Click on the GST Return Filing period and enter the dates with the help of the calendar available

- Step 4:On clicking on the search option all the relevant details would be displayed on the screen.

When Tracking Through the Status

- Step 1: Visit the official GST portal and select the search taxpayer option

- Step 2: You will see the GSTIN/UIN option, enter your GSTIN ID and fill in the exact captcha code and then click on the search command. Captcha Code will appear only when you enter your GSTIN ID

Once all of the information is submitted, the page will display all of the relevant information about the company, including the legal name, jurisdiction, date of registration, GSTIN/UIN status, and data from all recent GST returns filed under various sub-headings.

Here is a step by step guide on how to download the GST returns online:

- Step 1: Enter your login details and click on ‘Login’

- Step 2: Click on ‘File GST Returns’

- Step 3: Select year and month, then click on ‘Search’

- Step 4: Click on ‘View GSTR 1’

- Step 5: Next click on ‘Preview’

- Step 6: Save in folder and right-click to show in folder.

The GST payment process is largely the same for all taxpayers. Payment is not required if the electronic cash ledger has a sufficient cash balance. In other words, if the cash balance is insufficient, the taxpayer must utilise a challan to deposit money into the cash ledger using prescribed payment methods. The following is an overview of the payment process for various taxpayer types

Regular Taxpayer

Around the time of submitting GSTR-3B, they must use the PMT-06 challan to make any GST payments to the electronic cash ledger. The details will be published in GSTR-3B. They can also generate a challan and pay for it before or after logging in, or while completing GSTR-3B returns.

Quarterly Taxpayer

These are taxpayers who have chosen to participate in the GST QRMP scheme. They must deposit tax directly utilising the PMT-6 in the first two months of a quarter and make payment while filing GSTR-3B in the last month of the quarter.

Taxpayers Filing Nil GST Returns

For the relevant tax period, whether for the month or quarter, these taxpayers have no sales or purchases, and no tax is due. They don’t have to use the challan or pay anything.

Composition Taxable Persons

These taxpayers must total up their sales/turnover information for the quarter in challan CMP-08 and pay the tax.

| Type of Offence | Penalty | Type of Offence | Penalty |

|---|---|---|---|

| Late Filing: | – ₹100 per day during which the failure continues, up to a maximum of ₹5,000 | Late Filing: | – ₹100 per day during which the failure continues, up to a maximum of ₹5,000 |

| – ₹100 per day during which the failure continues, subject to a maximum of quarter percent of the person’s turnover in the state where he is registered for annual return | – ₹100 per day during which the failure continues, subject to a maximum of quarter percent of the person’s turnover in the state where he is registered for annual return | ||

| Late Payment of Tax: | Interest on the tax due calculated from the first day the tax was due to be paid | Late Payment of Tax: | Interest on the tax due calculated from the first day the tax was due to be paid |

| Excess Claim of Input Tax Credit or Reduction: | Interest on the undue excess claim or undue reduction in output tax liability | Excess Claim of Input Tax Credit or Reduction: | Interest on the undue excess claim or undue reduction in output tax liability |

| Delayed Payment to Supplier: | Interest on the amount due added to the recipient’s liability | Delayed Payment to Supplier: | Interest on the amount due added to the recipient’s liability |

| Cancellation of Registration: | Registration may be canceled if: | Cancellation of Registration: | Registration may be canceled if: |

| – Regular dealer hasn’t furnished returns for 6 continuous months | – Regular dealer hasn’t furnished returns for 6 continuous months | ||

| – Composition dealer hasn’t furnished returns for 3 quarters | – Composition dealer hasn’t furnished returns for 3 quarters | ||

| – Voluntary registered person hasn’t commenced business within 6 months of registration | – Voluntary registered person hasn’t commenced business within 6 months of registration | ||

| – Registration obtained by fraud, wilful misstatement, or suppression of facts | – Registration obtained by fraud, wilful misstatement, or suppression of facts | ||

| Confiscation of Goods and/or Conveyances: | Confiscation of goods and/or conveyances and fine of ₹10,000 or an amount equal to the tax evaded | Confiscation of Goods and/or Conveyances: | Confiscation of goods and/or conveyances and fine of ₹10,000 or an amount equal to the tax evaded |

| Imprisonment and Fine: | Imprisonment and fine applicable for specific offenses | Imprisonment and Fine: | Imprisonment and fine applicable for specific offenses |

| Other Penalties: | – ₹10,000 or amount equivalent to the tax evaded for specified offenses | Other Penalties: | – ₹10,000 or amount equivalent to the tax evaded for specified offenses |

| – Penalty of up to ₹25,000 for aiding or abetting offenses listed above | – Penalty of up to ₹25,000 for aiding or abetting offenses listed above |

Taxpayers registered under the Composition Scheme must pay taxes using CMP-08 every quarter and file GSTR-4 annually through the GST Common Portal or a GST Facilitation Centre. The due date for the GST return for Composition Scheme registrants is the 18th of the month following each quarter, namely 18 April, 18 July, 18 October, and 18 January. The GST return must contain details of:

- Details of supplies received from registered and unregistered persons, both intra-state and inter-state, should be provided on an invoice-wise basis.

- The GST return filed by a Composition Scheme supplier must also contain a summary of the supplies they have made to their customers.

If a person registered under GST has chosen to pay taxes under the Composition Scheme from the start of a financial year, they must file monthly GST returns on the 10th, 15th, and 20th of each month, and keep filing monthly returns until the due date of furnishing the return for September of the next financial year or the annual return of the preceding financial year, whichever comes first. Therefore, even if a taxpayer opts for the Composition Scheme from April onwards, they must continue filing monthly GST returns until September.

Vriddhi Fintax has a fleet of GST experts to support you in all spheres. We help more than 1000 companies with GST related compliances on an every month basis.

- You don’t want to worry about keeping tabs on due dates, we will remind you

- Simplified system to keep your invoices and other documents in place and organised

- Experts file your returns and ensure you get a proper input tax credit and save money

- No more trying to make sense of changes in GST laws and processes, our experts file returns for many other businesses like yours and are always up to date with it

- Your filing with be error-free and you will save a lot of time and effort

- We bear any sort of penalties incurred due to any erroneous delay from our end.

6 February 2023

Individuals who wish to enroll or continue with the Composition Scheme for the financial year 2023-24 can submit a declaration in Form CMP-02 through the GST portal by 31 March 2023.

17 December 2022

- Decriminalisation of three GST offences:

- Obstruction of an officer’s performance of duties

- Increase in the tax threshold amount for launching a criminal GST offence from the current limit of ₹1 crore to ₹2 crores, except where fake invoices are involved

- Decriminalisation of compounding of offence up to a certain limit in order to lessen the workload of courts

- GST on pulse husks for cow feed (including chilka and concentrates) was decreased from 5% to 0% as part of a few rate rationalisation issues. The 5% GST on ethyl alcohol that was previously paid at a concessionary 18% rate was also extended to refineries for the purpose of mixing with gasoline

- A few tax-related issues were clarified, including the GST on equipment used by oil companies for exploration and how to handle invoice mismatches in GSTR-1 and GSTR-3B in the early years

- To make e-commerce more accessible to all micro-businesses, e-commerce operators can let suppliers to be both registered under the composition system and unregistered vendors

- The 48 meeting’s agenda did not include the second report on casinos and online gaming because it was not distributed

- Regarding a GST rate increase, no decision has been made.